Return on Common Equity

Return on equity can be calculated by dividing net income by average shareholders equity and multiplying by 100 to convert. Part 2 of 3.

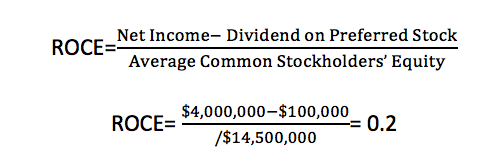

Return On Common Stockholders Equity Roce Formula Example

Equity is a particular body of law that was developed in the English Court of Chancery.

. New York State Common Retirement Fund Albany posted a net return of 95 for the fiscal year ended March 31 Thomas P. Tangible Common Equity - TCE. Return on Equity is a profitability metric used to compare the profits earned by a business to the value of its shareholders equity.

This profitability helps to gauge a companys effectiveness when it comes to using equity funding to run its daily operations. Return on equity represents the percentage of investor dollars that have been converted into earnings. Return on equity ROE is the amount of net income returned as a percentage of shareholders equity.

Return on Equity Meaning. The common reason why it is risky is that this ratio is the financial ratio figure. Still a common shortcut is to compare a companys performance to the long-term average ROE of the SP 500 which stands at 14 as acceptable and everything below 10 as quite poor.

Using Return on Equity Information. The return on equity ratio can be described as a financial ratio that helps measure a companys proficiency to generate profits from its shareholders investments. Companies can finance themselves with debt and equity capital.

A 15 ROE indicates that the corporation earns 15 on every 100 of its share capital. Calculate Return On Equity ROE. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders.

Increasing profits does not. Return on equity measures a corporations profitability by revealing how. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings.

Divide net profits by the shareholders average equity. ROE is calculated as Net Income divided by Shareholders Equity and is presented as a percentage. Its general purpose is to provide a remedy for situations where the law is not flexible enough for the usual court system to deliver a fair resolution to a case.

By figuring out the ROE of a company individuals can find out how much post-tax income is left in. Return on Equity ROE is the profitability ratio used by investors and shareholders to assess how profitable the company is compared to others budget or expectations. Goodwill was 581 thousand as of June 30 2022 and December 31 2021.

The concept of equity is deeply intertwined with its historical origins in the common law system used in England. Increase profit margins As profits are in the numerator of the return on equity ratio increasing profits relative to equity increases a companys return on equity. Return On Equity - ROE.

As of June 30 2022 the return on average common equity and return on tangible common equity was 2283 and 2315 respectively. A company with an ROE of at least 15 is exceptional. Mathematically Return on Equity Net.

Tangible common equity TCE is a measure of a companys capital which is used to evaluate a financial institutions ability to deal with potential losses. Return on Equity ROE. Cite this calculator page.

If youd like to cite this online calculator resource and information as provided on the page you can use the following citation. This will give you a better idea of. Use more financial leverage.

A company can improve its return on equity in a number of ways but here are the five most common. That is why this ratio creates any risks to shareholders whenever it becomes the priority in performance measurement. Return on equity ROE reveals how much profit a company earned compared to the total amount of shareholders equity.

Compare the ROE over the past 5 to 10 years. Avoid companies that have an ROE of 5 or less.

What Is The Return On Common Equity Ratio Bdc Ca

Return On Equity Roe Formula Examples And Guide To Roe

Return On Common Equity Definition And Example Corporate Finance Institute

Comments

Post a Comment